Anvil Townhomes Waitlist Application Page

Anvil Townhomes Waitlist Application

APPLICATION PERIOD: 12:00am September 29th, 2025, to 11:59pm November 3rd, 2025. Applications must be submitted according to the official Application Packet below. Late and/or incomplete Applications will not be considered or reviewed.

Application Period Opening | September 29th, 12:00am |

Application Period Closing | 11:59pm on November 3rd |

Initial Application Review & Notification of Application Status | November 5 |

Application Remedy Period | November 6 - November 13 |

Final Admin Decision of Application Status | November 14 |

Appeal Period | November 14 - 26 |

| Appeal Hearing (if any) and Waitlist Drawing | December 1 |

For application materials in Spanish, scroll to the bottom of the page.

How the Application and Waitlist Process Works

When you submit this application, you are applying to be entered into a Waitlist Drawing. The Drawing is a random selection process that is used to decide the order in which applicants may be offered the chance to buy a home. The waitlists are organized according to the eligibility requirements of the homes.

Only applicants who meet the eligibility requirements will be included in the Drawing.

Being placed on the Waitlist does not guarantee that you will be able to buy a home—it only determines the order in which applicants will be offered the opportunity to purchase a home.

Once the Waitlist is set:

SHA will contact the first person on the list to begin the Buyer Approval Process.

If that person is approved, they will be offered the home.

If they are not approved or decline, they will be removed from the Waitlist, and SHA will move to the next person.

This process will continue until the home is successfully sold.

*Disclaimer: None of the information on this website or the official Anvil Townhomes application constitutes an offer to sell or the solicitation of an offer to buy a home.

Eligibility and Use Requirements

The Anvil Townhomes is a mixed-income development designed to create homeownership opportunities for households that intend to use the home as their primary residence. The cost to build the homes has been subsidized by public and private donations from the Colorado Department of Local Affairs, the Colorado Health Foundation, San Juan County, Town of Silverton, the Colorado Housing and Finance Authority, and the Colorado Department of Health and Environment. The homes have restrictions on buyer income-levels and use and resale restrictions to protect the substantial public and private investment in the affordability of these homes.

Eligibility Requirements:

- Applicant households' gross income (total income before any deductions) must be less than either 80% Area Median Income (AMI), 100% AMI, or 140% AMI to qualify for the waitlists.

| 2025 San Juan County Area Median Income Levels | |||

|---|---|---|---|

Household Size | 80% AMI: Gross Annual Income | 100% AMI: Gross Annual Income | 140% AMI: Gross Annual Income |

1 Person | $57,120 | $71,400 | $99,960 |

2 Person | $65,280 | $81,600 | $114,240 |

3 Person | $73,440 | $91,800 | $128,540 |

4 Person | $81,600 | $102,000 | $142,800 |

5 Person | $88,160 | $110,200 | $154,280 |

6 Person | $94,720 | $118,400 | $165,760 |

Applicant must get a mortgage pre-qualification letter for the sale-price of the home you are applying for or show alternative proof of funds for the sale price.

Applicant must demonstrate the anticipated monthly housing costs (primary mortgage payment, interest, insurance, taxes and HOA fees) are less than 35% of applicant's monthly income.

Applicant must have completed a HUD-certified homebuyer education course in the past 3 years.

Use Restrictions:

The owner must use the property as their primary residence and reside in the property 8 months of the year.

The home appreciates at a 1% annually compounded rate.

Short term rental is prohibited.

The property is governed by Affordability Covenants, Program Guidelines, and an HOA. Applicants are encouraged to review these documents prior to applying and is included in the 2025 Application Packet below.

Available Properties

≤80% AMI 2-Bedroom (3 Units Available)

- Details: 2-bedroom, 1.5-bathroom

- Square footage: 1,024

- 2025 Sale Price: $245,000

≤100% AMI 2-Bedroom (3 Units Available)

- Details: 2-bedroom, 1.5-bathroom

- Square footage: 1,024

- 2025 Sale Price: $318,000

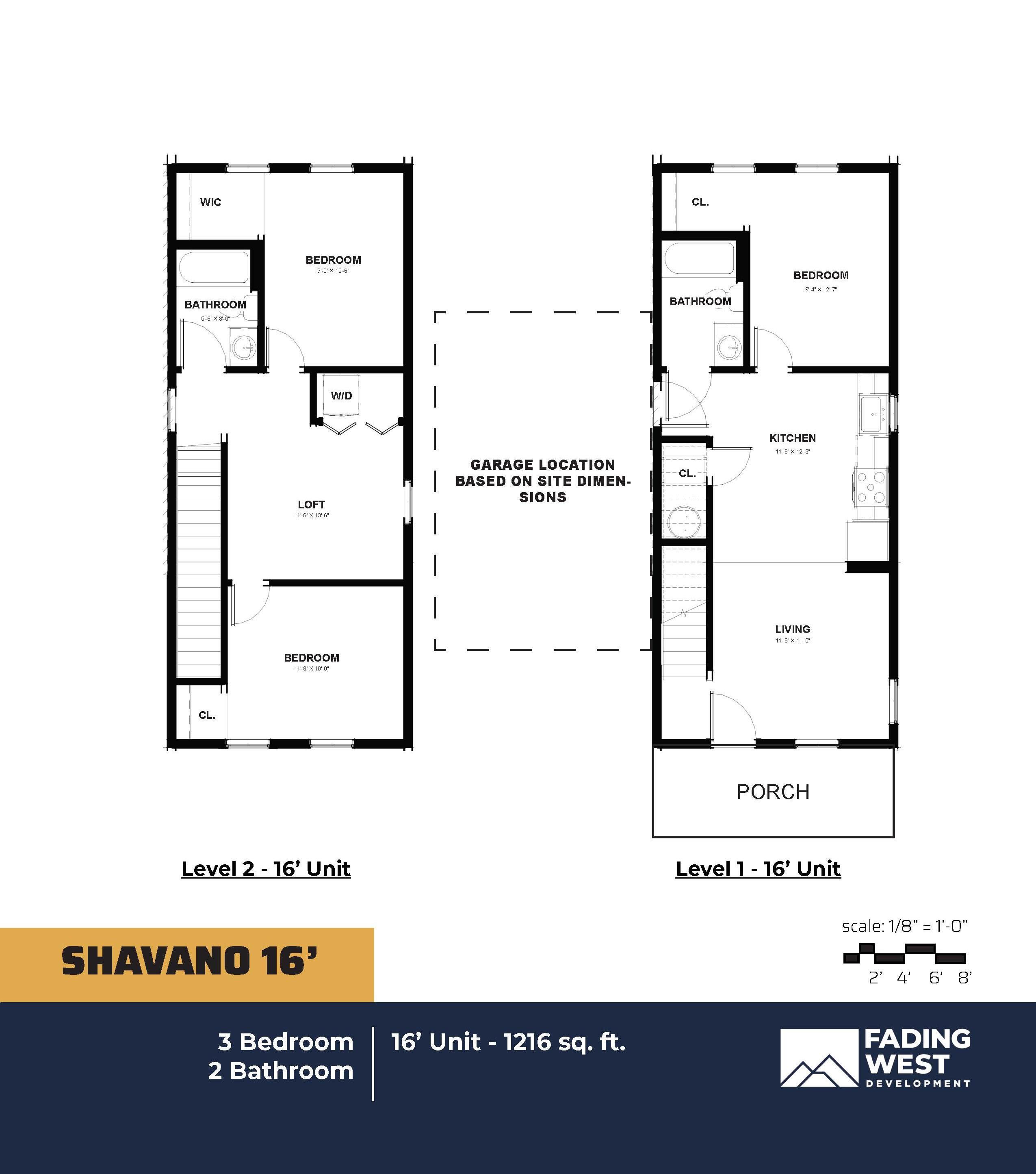

≤100% AMI 3-Bedroom (2 Units Available)

- Details: 3-bedroom, 2-bathroom

- Square footage: 1,216

- Accessibility: Visitable and sensory impairment designs (1 units)

- 2025 Sale Price: $367,500

≤140% AMI 3-Bedroom Single Family (1 Units Available)

- Details: 3-bedroom, 2-bathroom

- Square footage: 1,216

- 2025 Sale Price: $529,200

Property Information

Each unit will have a front porch, back yard, an assigned off-street parking space. Only the single-family unit at 140% will have a garage.

How to Apply

Application Instructions, Information and Forms

The application instructions and required information are included in the application packet. The application itself is an online form and requires multiple file uploads. You must gather and prepare all documents listed in the application checklist before beginning the online form, as you will not be able to submit your application without uploading them.

The application process is as follows:

- Review the Application Packet.

- Complete forms and gather necessary documentation using the application checklist.

- Complete online application.

Application Process Overview

- STEP ONE: Determine Income Eligibility: Applicants may apply for the Waitlist of any unit for which the following conditions are met:

- Household gross income is below the unit’s Income Limit.

- Can obtain a mortgage pre-approval for the sale price or demonstrate proof of funds.

- Can demonstrate the monthly housing costs, including primary, interest, taxes, insurance, and HOA fees are less than 35% of the Applicant’s gross monthly income.

- Has completed a HUD-approved homebuyer education course in the past three years immediately prior to the closing date of the application period.

- STEP TWO: Review Program Requirements and Property Covenants

- STEP THREE: Complete a HUD Certified Homebuyer Education Course. The SHA will accept certificates of completion of a Homebuyer Education Course dated within the past three years.

- STEP FOUR: Gather necessary income-verification documentation. Using the Application Checklist, gather supporting documentation to upload in your online application form. Conveniently, your mortgage lender will need to see this information as well.

- STEP FIVE: Obtain a mortgage pre-qualification letter letter or show proof of funds for the sale price of the home. When selecting a mortgage broker to work with, it is strongly recommended to work with someone who is familiar with and comfortable with lending for a home encumbered by affordability and use covenants. If you are paying cash for the property, proof of funds must be demonstrated. *YOUR MONTHLY HOUSING EXPENSES MUST NOT EXCEED 35% OF YOUR MONTHLY GROSS INCOME. For the purpose of this application, housing expenses include: the primary mortgage payment (Primary), Interest, Taxes, Insurance and HOA fees (together, commonly referred to as “PITI” costs). You must request your lender to include estimated taxes, insurance, and interest in your pre-approval letter, as this is not typically included in the standard pre-approval letter. Please refer to the Property Details section for HOA fees.

- STEP SIX: Pay Application Fee. You can pay the application fee online using the Town of Silverton’s Xpress Bill Pay or in-person with card, check, or cash at Silverton Town Hall (1360 Greene Street). You will need a receipt of this payment to upload when completing the online application.

- STEP SEVEN: Complete necessary Application Forms. Refer to the Application Checklist to determine which forms apply to you. Necessary forms for all applicants are:

- Waitlist Applicant Agreement

- Authorization to Release Information

- STEP EIGHT: Once you are ready, you may begin the online application form to formally submit your application.

These properties are subject to use restrictions and requirements to ensure they are used as-intended, which is to provide affordable homeownership opportunities for years to come. Before applying, make sure the restrictions and limitations are in line with your homeownership goals.

The Anvil Townhomes are subject to the Silverton Affordable Housing Guidelines. The program details are under the 300’s section of the Guidelines. In addition, there are Affordability Covenants and an Homeowners Association (HOA) that place restrictions on the property.

Application Contact: Anne Chase

For any questions or support, contact Anne at achase@silverton.co.us, or 970-880-0278.