FAQ's

Date of upcoming homeownership lottery: To Be Determined.

The project closest to completion is the Anvil Townhomes. For project updates, we recommend following the Silverton Housing Authority Regular Meetings and signing up for the Silverton Housing Authority Email List. All SHA lotteries will be posted on the Home page of the SHA website, in the general circulation of the Silverton Standard Newspaper, and the SHA Email list.

In the meantime, taking the following steps can help prepare you for future lotteries / homeownership opportunities:

- Take a Homeownership Education Class with HomesFund. 2025 Silverton HomesFund class dates to be announced. Participation in a HomesFund In-Person Homeownership Education Class will be a prerequisite for applying for a SHA Homeownership Lottery.

- Read the Silverton Affordable Housing Guidelines to familiarize yourself with the requirements to qualify for Silverton Housing Authority programs.

- Organize relevant income and asset information i.e. prior years' tax returns, paystubs, bank statements.

- Get Pre-Qualified for a mortgage - *note, SHA Lotteries require Prequalification letters dated within 90 days of Lottery opening date. View the Colorado Housing and Finance Authority's recommended Lender Interview Questions.

- Research down-payment assistance and mortgage products you may be eligible for.

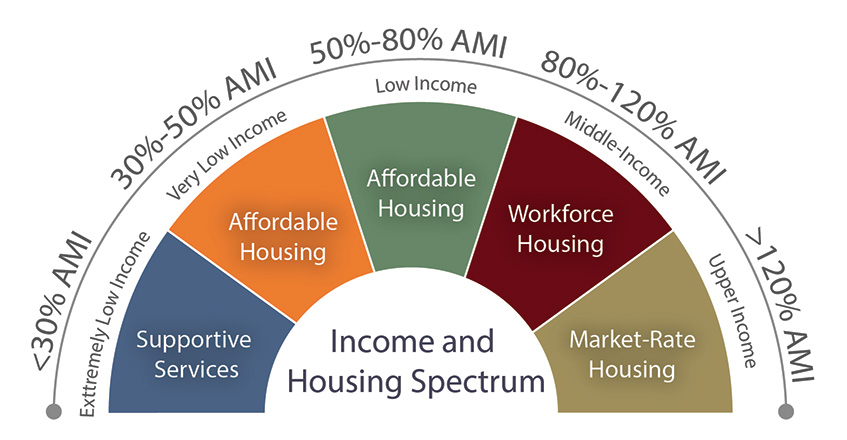

Each Spring, the U.S. Department of Housing and Urban Development (HUD) calculates the area median income (AMI) for every geographic region in the country using data from the US Census-based American Community Survey. The area median income is the midpoint of a region's income distribution, meaning that half of the households in a region earn more than the median and half earn less than the median. A household's income is calculated by its gross income (total income received before taxes and other payroll deductions).

- Low-income households earn less than 80% of the AMI

- Very low-income households earn less than 50% of the AMI

- Extremely low-income households earn less than 30% of AMI

Image Source: Humanizing Data: Area Median Income (AMI) and Affordable Housing Policy - Camoin Associates

Learn more about HUD's Income Limits and FAQ's here.

The Colorado Housing and Finance Authority (CHFA) adapts HUD's numbers to create each Colorado county's maximum affordable rents. CHFA's calculation is the Colorado Department of Local Affairs (DOLA) standard for administering funding for affordable housing programs. Silverton Housing Authority relies on financial support from CHFA and DOLA to fund affordable housing developments.

Affordable Sale Prices are calculated by the Silverton Housing Authority using the Colorado Division of Housing (DOH)'s Homeownership Budget Worksheet annually as HUD updates AMIs.

The SHA Board meets usually once a month, up to two times a month before the Town of Silverton Board of Trustees Regular meetings. Check the Calendar for upcoming meetings, subscribe to the Town of Silverton Email List for official meeting notices, and the Silverton Housing Authority Email List for upcoming meeting information.

For archived meetings and meeting packets visit the Public Records page.

To make a comment to the SHA Board visit the Get Involved page.

The Silverton Affordable Housing Guidelines were developed by the SHA Board and Staff to:

- Provide transparency and clarity

- Promote fairness

- Ensure compliance

- Guide future development

- Enhance efficiency

The Affordable Housing Guidelines layout the overarching qualification standards of all affordable housing projects, but please note that each development, referred to as a Housing Program, may have unique standards. The qualification requirements of each application round will be included in the application packet which can be found on the Home Ownership Application page when an application is open.

A Guideline Digest is being created, but in the meantime, you can explore the Guidelines Document Here.

There are two levels of evaluation to determine the eligibility of applicants: Qualification and Priority.

- Qualification refers to the most general requirements for housing programs. Qualification means the following standards are met: Income Level, Property Ownership, and Net Assets. On most occasions, SHA will consider exception requests for the Property Ownership and Net Assets Standard.

- Income Level: This standard is subject to the housing program and deed-restrictions associated with each housing unit. Income levels, also referred to as AMI, for San Juan County can be found here.

- Property Ownership Standard: Ownership by any member of a household of any real property, developed or undeveloped residential or commercial, located outside of San Juan County is not permitted. Ownership of a property within San Juan County of commercial property or undeveloped residential property is permitted. Ownership of a develop residential property located in San Juan County is restricted - see Section 103.2.D.4.i of the Guidelines.

Net Assets Standard: Household net assets shall not exceed eighty percent (80%) of the original purchase price of the housing unit. As defined, assets of a household include all members of a household including children. *Exclusion of assets may be requested for money held in verifiable education, healthcare, and retirement accounts.

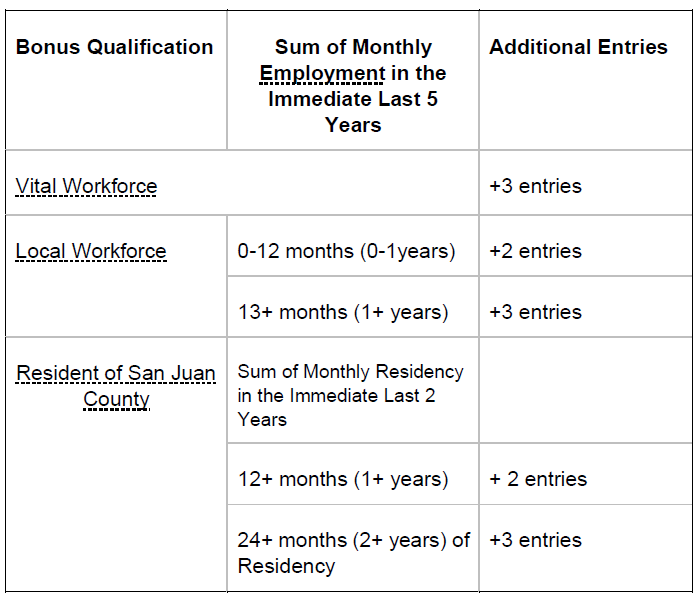

Bonus refers to the specific requirements that earn applicants additional entries into the application lottery based on type of employment / disability or retirement status, as applicable.

The Guidelines have a section explaining the exception request procedure to any of the Qualification Standards.

The Silverton Housing Authority does not currently own any rental units, however, there are plans to build several small apartment buildings in the near future for rent.

In the meantime, San Juan County owns and operates the Anvil Mountain Apartments which are deed-restricted and affordable. However, the waitlist is quite long. Contact San Juan County's Social Services department here with questions about the Anvil Mountain Apartments. Otherwise, the Silverton Colorado Housing and Jobs Facebook page is commonly used by tenants and landlords alike.

Housing Solutions of the Southwest offers Housing Counseling, including the following services:

- Money management

- Resolving issues impacting tenancy and ability to obtain housing

- Search for affordable housing & referrals.

- Fair housing issues and referrals

The most common measure of housing affordability assesses the “burden” housing costs put on a household. If a household pays more than 30% of their gross income in rent or mortgage payment, taxes, and basic utilities, they are considered to be “cost-burdened” and have a housing need.

Income Levels are created by the Area Median Income. Let's say you are a single person making $66,000 a year - you would be in the 100% AMI Income level in San Juan County per the 2024 AMI Levels. Affordable rental rates and sale prices are calculated by taking 30% of annual income (for-sale prices include mortgage interest rates, insurance, etc...), so that occupants of subsidized affordable housing don't pay more than 30% of their income on housing.

You can review archived meeting packets, meeting minutes, and meeting recordings on the About SHA page under Public Records. Other public records including resolutions can also be found there.